|

Amiyatosh Purnanandam I'm the Denise and Ray Nixon Endowed Chair in Finance at the McCombs School of Business at the University of Texas, Austin. My research covers a wide range of topics in banking, FinTech, mortgage, and corporate finance. My recent research work is mostly related to deposit insurance, digital payments, and measurement & detection of risk in banking. |

|

ResearchMy research interests span several key areas in finance. In banking, I focus on the relationship between banking and the real economy, measurement and monitoring of risk in banks, and bank loans. I have worked on several topics in real estate and mortgages, particularly studying the subprime mortgage crisis and the RMBS market. In the FinTech space, I research digital payments and online lending platforms. In corporate finance, I study risk management, IPOs & SEOs, capital structure, and security design. I also conduct research in credit risk, analyzing default risk and security returns, as well as the modeling of credit risk. Below are some of my recent research works. Please check my Google Scholar page or my research page for more details. |

|

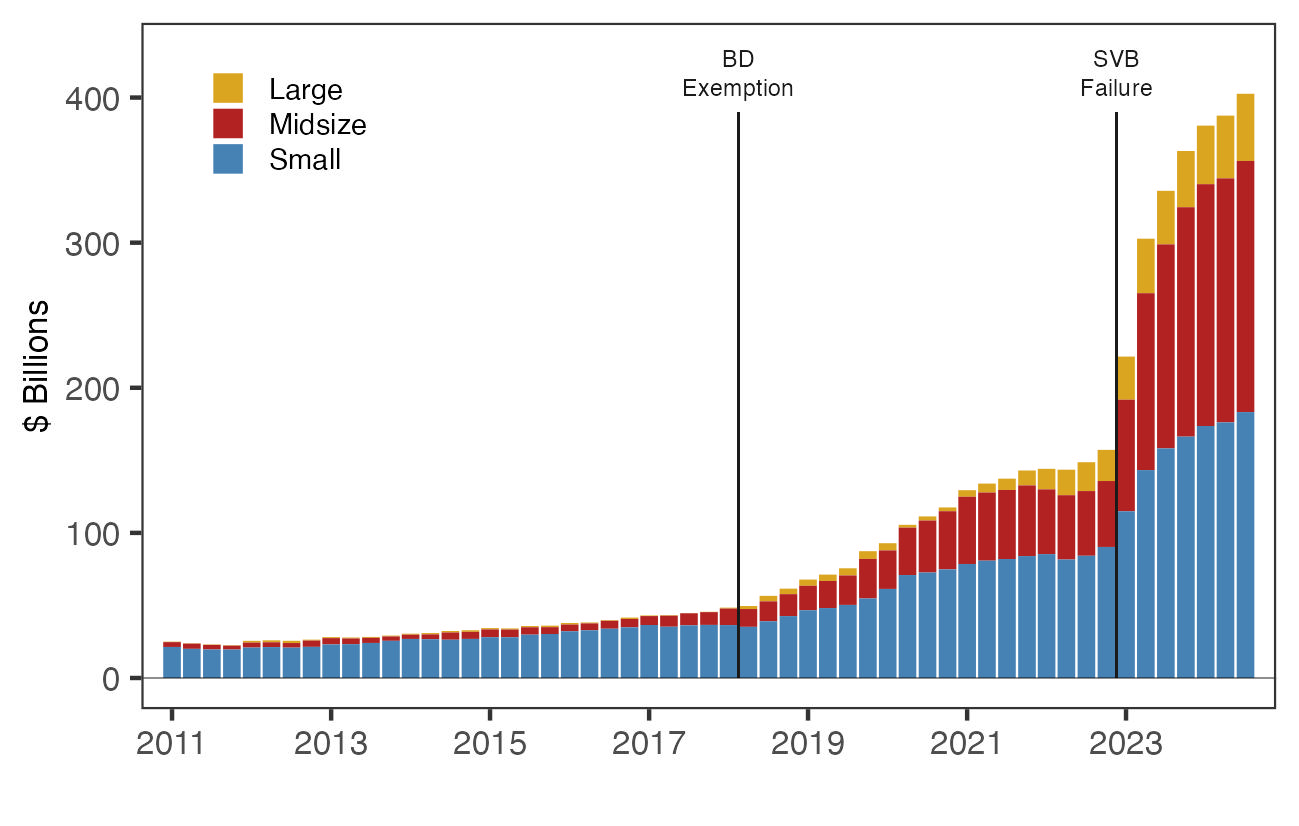

The economics of market-based deposit insurance

Edward Kim, Shohini Kundu, Amiyatosh Purnanandam Supported by NBER Initiative on Market Frictions and Financial Risks, 2025 We examine the financial stability implications of deposit insurance using reciprocal deposits, a financial innovation through which banks can break up large deposits and place them with others in an offsetting manner. We show that higher insurance coverage allowed banks to stem deposit outflows during the 2023 banking crisis. Network banks paid lower deposit rates, grew larger, and expanded their local deposit market share, while assuming greater exposure to interest rate risk. We discuss the trade-offs of deposit insurance and its impact on the banking sector's industrial organization. |

|

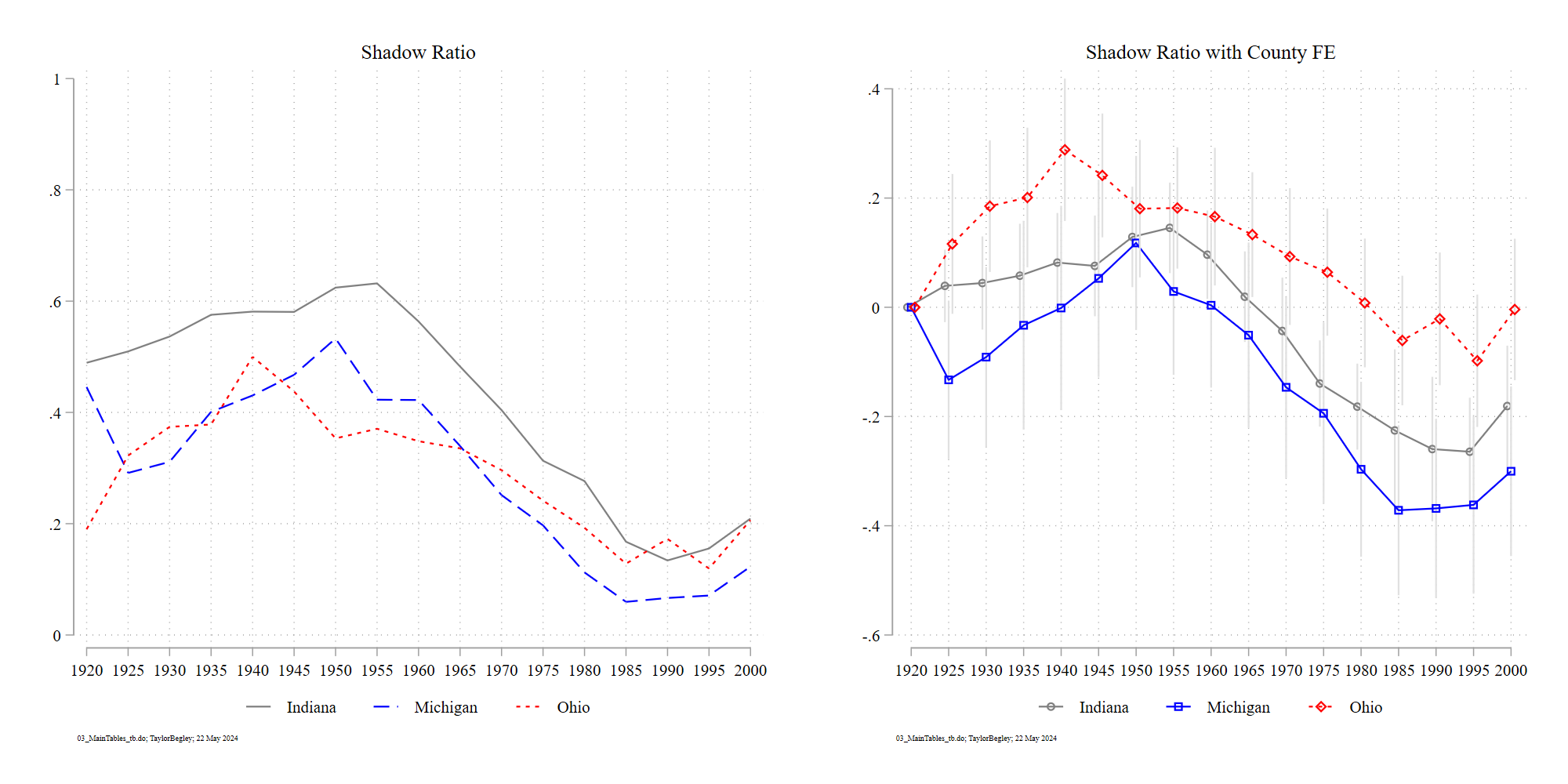

Shadows on Main Street

Taylor Begley, Virginia Traweek, Amiyatosh Purnanandam We examine how shadow banks shape the reallocation of real assets at a local level. We first construct a novel county-level panel dataset of all financial institutions---not just banks---from Yellow Pages in Indiana, Michigan, and Ohio from 1920–2000. We document that shadow banks constitute a significant and persistent component of local financial architecture, representing over one-third of financial firms. Using changes in global corn prices as an exogenous shock to the economics of farming, we find that a higher shadow bank share in the local economy significantly enhances asset reallocation in response to economic shocks. In these counties, higher corn prices lead to greater farm consolidation, more efficient use of physical capital, and a larger increase in land values. The benefits come at the expense of higher volatility in land prices in these counties, consistent with an efficiency-volatility trade off. Our paper provides the first granular, long-run evidence that shadow banks play a key complementary role in facilitating asset reallocation. |

Miscellanea |

Recent Policy Talks & Panel Discussions |

Fed Dallas, 2025: Panel Discussion on Bank Funding

India Policy Forum, 2025: Drivers of corporate Investment in India Federal Reserve Bank of Kansas City: Future of Banking Conference, 2025 Columbia University India Summit, 2025 CAFRAL, Reserve Bank of India Keynote Address on Deposit Insurance G7 Digital Payment Expert Group: Digital payments and financial inclusion. Kautilya Economic Conclave, New Delhi: Financial Sector Resiliency in India. India Policy Forum, 2024: How digital payments can help with economic development. G20 Financial Stability Reforms: Evaluation of post-GFC securitization reforms. |

|

Design and source code from Jon Barron's website |